By Sean Hargrave, contributor, and Sara Downey, thought leadership, Dell Technologies

Cryptocurrency and crypto media “tokens” are set to become an ever more important part of mainstream life, from getting paid and enjoying a hobby to paying for everyday goods and planning for retirement.

That is according to Camila Russo, founder of The Defiant crypto website and author of “The Infinite Machine,” which tells the story of how the original cryptocurrency, Ethereum, got off the ground. To illustrate that the technology should now be considered mainstream, she revealed to Dell Technologies World delegates that Ridley Scott’s production company, Scott Free, is developing her book into a movie, financed in part by NFTs (Non-Fungible Tokens).

Her announcement coincided with the host of the session, Chief Corporate Affairs Officer JJ Davis, pointing out that Dell had just dropped its first NFT, which was available for attendees to download.

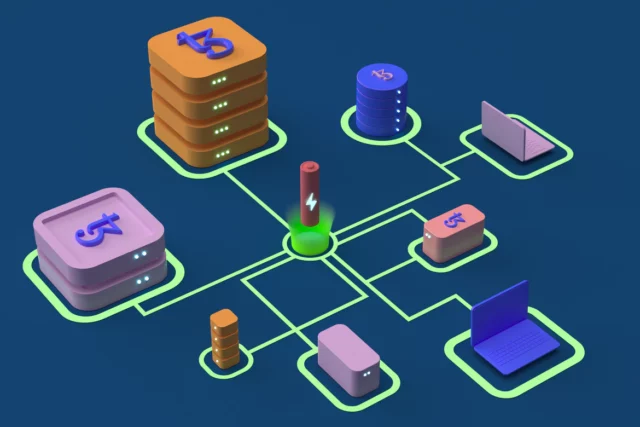

These tokens of digital art and collectible media use the same blockchain technology as cryptocurrencies to maintain a distributed ledger that records both who made and who now owns a token, alongside a record of any amendments. The idea is that the image cannot be copied and used by third parties but will always remain owned by the person, or group of people, who have paid for the piece of digital art or collectible.

Now the technology is firmly established, the sums involved can be huge. The most expensive shared NFT, named “The Merge,” was bought by just under 29,000 people for nearly $92 million collectively. A collage of 5,000 NFTs, called “The First 5000 Days,” sold to a single investor at a Christie’s auction for $69 million in 2021.

Finance without authorities

To understand the appeal of crypto, Russo believes observers need to recognize that, on one hand, it’s a way of building communities around shared interests (the digital equivalent of people collecting baseball cards or indulging in their collective love of cats). At the same time, it is also a way for citizens of the world to transact and invest through P2P networks without the need for an established regulator, such as the Federal Reserve.

She realized the power of this new movement nearly a decade ago when working in Buenos Aires for Bloomberg News. As was the case with most like-minded professionals who were paid in Argentinian Pesos, she used her salary to pay bills each month before converting the remainder into U.S. dollars to protect against rampant inflation. It was the only way people could protect their income and save for the future. Then, one day, that option was banned.

“The president announced she was banning dollar purchases, and I thought, is that actually true?” she recalls. “I logged on to my bank account, and the option was just not there anymore. For me, it really made an impact. How can a government or third party just take control and tell you what you can and can’t do with your own money?”

By using blockchain technology to buy cryptocurrency, people can avoid such government decisions. They can also attempt to circumvent censorship. If, for example, social media posts have a record of what was said at a given time, as well as all edits and deletions, a permanent record of a message that authorities try to take down can be maintained. This immutability can also stem the flow of misinformation: one of the greatest scourges of the digital age, and algorithms that beget yet more fake news.

“Crypto is a tool, it’s neutral, it can be used for good or for evil.”

—Camila Russo

Positive developments

So, there are potential opportunities around crypto that go beyond speculating whether the wildly fluctuating prices for different types of coin will move in an investor’s favor. The technology can help protect incomes and allow people to invest in the future as well as communicate with one another with less government censorship. For online creatives, the technology also opens up the opportunity to create collectible NFTs and artwork to monetize their work, which is often built collaboratively. However, as with any technological advance, there is both an upside and a downside.

Crypto is a tool, it’s neutral, it can be used for good or for evil,” Russo says. “Because it’s so revolutionary, it really does open up the world to new opportunities that we never had before. And I think that’s hugely positive, such as creators monetizing their work to a global market for the first time.”

Governance and scams pose challenges

On the downside, though, there are some flaws in how platforms operate and how cybercriminals are relentlessly trying to steal account passwords or keys.

“Whenever I tweet something, I have many bots replying there’s a free crypto giveaway, so give me your private keys,” she says.

“Nobody should ever give away their private key to anyone on the internet, and yet people fall for these things because there’s still a lack of education.”

There are also additional concerns to bear in mind when considering investing in cryptocurrencies or NFTs. Apart from the unpredictable fluctuations in prices, there is also the “gas,” or transaction fees, to consider. These charges also fluctuate and can sometimes be higher than a traditional fee for changing money or buying collectible artwork from a third party.

Another downside of crypto platforms is governance. Tying down identity can be problematic when people can own multiple “wallets.” Additionally, the votes that platforms and communities regularly hold to gauge opinion and decide future direction are not run as democratically as they might first appear. As in life, the rich and powerful are already beginning to dominate, Russo laments.

“There is a kind of oligarchy that forms because, instead of having one person, one vote, you have one token, one vote, and that means that the person with the most tokens has the most power,” she says. “Essentially, the power goes to the people with more money, so I think that’s an issue that needs to be addressed and fixed.”

As these challenges are addressed, Russo predicts that just as the last 20 to 30 years have seen all businesses become internet companies, the future will also see them transition to crypto as the technology becomes more mainstream. Its ability to add a layer on top of the internet that made “value exchange native to the web” meant that finance was the most obvious first major market, but more will follow, Russo says. All other industries will follow, she insists, because crypto offers better efficiency and transparency and “is just better tech.”