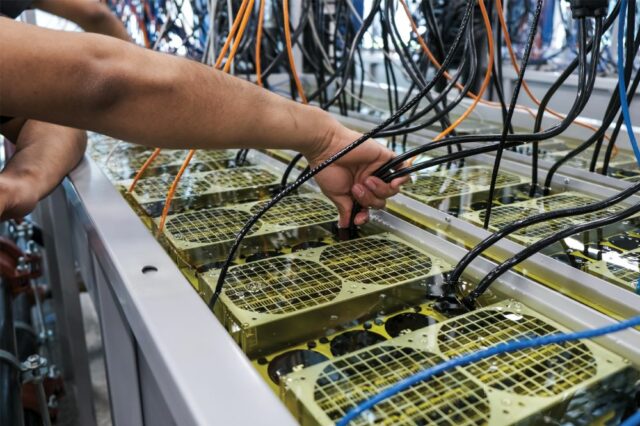

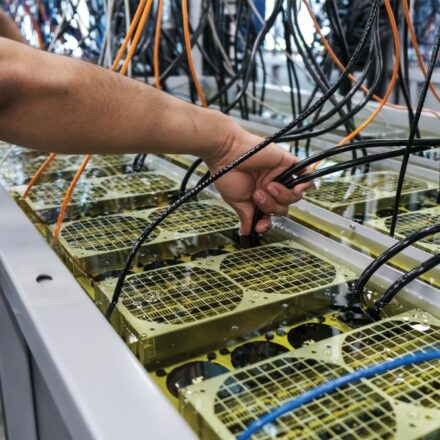

In a former call center on the outskirts of Atlanta, rows of high-powered computers lie immersed in tanks of synthetic oil that absorbs their heat as they generate bitcoins in an industry under siege over its energy use.

The new facility built by CleanSpark, a Las Vegas-based energy company turned bitcoin miner, is one marker of the firm’s commitment to sustainability and reducing its carbon footprint, its managers say.

The oil immersion saves on energy that would normally power fans to cool the machines while boosting their hash rate—the computational power used in bitcoin mining. The result is computers that could last up to 30% longer than fan-cooled units, reduced industrial e-waste and no complaints from neighbors about noise pollution.

“It’s a lot more efficient than a traditional air-cooled facility,” says Isaac Holyoak, chief communications officer, who leads CleanSpark’s environmental, social and governance (ESG) program. “It’s one of the ways we work to make our operation sustainable, not only in terms of our energy sources but in terms of the impact we hope to have on the communities we operate in.”

It’s one of the ways we work to make our operation sustainable, not only in terms of our energy sources but in terms of the impact we hope to have on the communities we operate in.”

—Isaac Holyoak, chief communications officer, CleanSpark

Explosive growth in cryptocurrency mining has made the sector a major global energy consumer, outstripping the consumption of some midsized economies. Boosting efficiency and tapping renewable energy sources have therefore become paramount for miners under pressure to reduce their environmental impact.

Net-zero goals at risk

The crypto mining industry consumed between 120 and 240 billion kilowatt-hours of electricity per year up to August 2022, equivalent to 0.4–0.9% of global consumption, according to estimates in a report released by the White House. Such a range exceeds the global share of countries like Argentina and Australia.

With the U.S. hosting about a third of global crypto-asset operations, policymakers fear the industry could hinder the country’s efforts to achieve its net-zero carbon pollution commitment by 2050.

Bitcoin, the most dominant crypto asset, accounts for up to three-quarters of the industry’s energy consumption alone. The power demands are tied to its underlying proof of work protocol, the decentralized mechanism involved in creating and verifying coins. It involves high-powered computers competing to solve complex cryptographic problems, with the winner adding a block of transactions to the digital ledger known as the blockchain, and receiving new bitcoins as payment along with a transaction fee.

The more bitcoins are mined, the more computing power is needed to solve increasingly complex problems to earn the next coin. Long gone are the days when enthusiasts could hope to mine bitcoin using an average home computer.

Global regulators circle amid market volatility

The industry’s power consumption has alarmed environmentalists and raised the attention of global regulators. China, once a major crypto mining hub, banned all digital asset mining and transactions in 2021.

In November 2022, New York became the first state to enact a ban on new permits for crypto miners that do not use 100% renewable energy.

The industry has come under further pressure from a slew of high-profile corporate failures and scandals that have seen the valuation of bitcoin plunge from a high of $69,000 in November 2021. With margins squeezed, miners must reduce costs, making the sourcing of cheaper, renewable energy an operational priority as well as an environment-focused goal.

“I don’t think anyone wants to see miners turn coal plants back on, at least in the United States, in order to mine bitcoin, and we hope that continues,” says Holyoak.

CleanSpark draws about 95% of its power from low-carbon sources, primarily nuclear and hydropower, along with solar and wind. It still relies on a small percentage derived from fossil fuels, including gas and coal.

Crypto proponents say it is wrong to single out the industry over its energy use, pointing to other sectors like gold mining that absorb a greater share of the world’s power generation. Perhaps counterintuitively, they also insist they can help fast-track the development of renewables by creating demand that incentivizes electricity providers to build infrastructure and boost supply.

Tapping renewables in heartland states

The vision has won over officials in several U.S. states. Wisconsin approved a tie-up between a digital asset firm and a power company to generate emission-free hydroelectricity for bitcoin mining. Texas, meanwhile, has welcomed crypto miners to set up in a state that offers ample sun, wind and tracts of cheap land. Texas already has a high proportion of renewables in its energy mix but has plenty of scope for more—if it can draw the investment.

That is where crypto miners come in, as their energy demands may make it viable for power companies to build renewable capacity and connect it to the grid. The concept is supported by investors who have poured hundreds of millions of dollars into infrastructure and battery storage in western Texas, where most electricity is generated from renewables.

Lancium, a power management firm for data centers, has been one of the beneficiaries of investor interest. The company raised $150 million from power companies to build bitcoin mines that will run on renewable energy across multiple sites in Texas.

“By increasing demand, we are able to improve the economics for renewable developers,” says Shaun Connell, executive vice president of power at Lancium.

There is one catch, though, for miners setting up in the Lone Star State. They must be prepared to shut down operations in times of peak power demand, such as during extreme weather events, to ease strain on the grid. With miners able to turn operations on and off instantaneously, Texas’s grid operator Electric Reliability Council of Texas (ERCOT) sees crypto operators adding stability to the grid in times of excess demand and supply.

“We can use cryptocurrency to soak up the excess generation and really provide a home for more wind and more solar to come to our state,” Brad Jones, the former interim chief executive of ERCOT, said in March 2022 before retiring from the role in October.

Gas-flaring technology promises reduced emissions

A more surprising development involves bitcoin miners setting up on oil fields to secure cheap electricity from excess natural gas. Although at odds with the narrative of boosting renewables in the energy mix, miners insist their cooperation can help reduce emissions.

The production of oil leaves raw natural gas as a byproduct, which is often unable to be fully captured or transported due to logistical reasons. Instead, producers burn the gas in a process called “flaring,” which sends carbon dioxide and methane into the atmosphere. Bitcoin miners are now swooping in to buy the gas cheaply from oil companies in Texas, Wyoming and other U.S. states and then divert it into generators to produce electricity to power their computers.

There’s a massive amount of flared gas in the U.S. The amount of flared gas in Texas could power the state of Texas.

—Matt Lohstroh, co-founder, Giga Energy

Crusoe Energy, a startup that has patented flaring technology and has worked with oil firms in North Dakota, says its gas generators can reduce methane emissions by about 99% and carbon dioxide emissions by up to 68.6%.

Texas-based startup Giga Energy, which specializes in building bitcoin mining farms powered by stranded and natural gas, is also cooperating with oil companies.

“There’s a massive amount of flared gas in the U.S.,” says Matt Lohstroh, the co-founder of Giga. “The amount of flared gas in Texas could power the state of Texas.”

While the startup is targeting Series A funding from investors in 2023, and its founders are bullish about its prospects, Lohstroh is mindful that the company’s operations may not have a long-term future in the United States amid the country’s push to meet net-zero pledges.

“Our largest expansion is going to be internationally,” he says.

Cutting energy use through ‘proof of stake’

Not all crypto assets guzzle electricity like bitcoin. The Ethereum network, whose native cryptocurrency ether is second only to bitcoin in market capitalization, slashed its energy use by ditching “proof of work” in favor of “proof of stake” (PoS), an alternative protocol that its developers say uses 99.9% less electricity. Ether is minted by validators who “stake” their coins as collateral and are chosen randomly to validate transactions. The mechanism does not involve the competition among high-powered computers that generating bitcoin does.

Despite PoS’s energy efficiency, critics argue the protocol is flawed and could lead to big digital asset holders’ taking control of the blockchain—an idea that is anathema to libertarian proponents of bitcoin.

For all the challenges facing the crypto-asset industry, ranging from market volatility to pressure from regulators, advocates insist it is here to stay and only one among a number of sectors under pressure to minimize its carbon footprint. “We think that the industry can work together to reduce emissions,” says CleanSpark’s Holyoak. “Crypto mining is not standing between the planet and its emissions targets.”

Lead photo: Oil immersion boosts the bitcoin mining machine’s hash rate and

extends its life span. Photo courtesy of CleanSpark.

Want to read more stories like this? Check out Realize magazine.